Nigeria

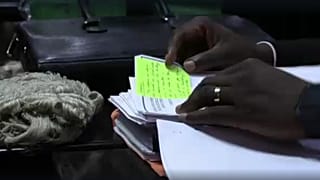

Nigeria has officially restricted massive cash withdrawals from the bank beginning Monday the 9th January in an effort to cool off inflation.

Nigerians will only be allowed to withdraw 44 dollars per week per individual and $11,000 for businesses, a policy that is most likely to affect millions of Nigerians especially businessmen and high cash intensive activities.

The stated goal of the authorities is to succeed in limiting the mass of banknotes in circulation, both to control illicit financial flows and corruption, and to modernise the payment system such as digital money transfers, mobile money or again the e-naira, the digital naira intended for businesses.

Finally, the objective is to better control inflation. However, as economists point out, the mass of banknotes in circulation represents only 6% of the total money supply.

Inflation would be better, they point out, if the state repaid the Central Bank its huge debt which, according to the Nigerian press, would amount to $48 million

01:00

Pix of the Day, 26 February 2026

Go to video

Jihadist group militants increase attacks in Nigeria-Niger-Benin borderlands

01:07

Nigeria paid Boko Haram ransom for kidnapped pupils: AFP investigation

Go to video

Toxic gas leak at mine in Nigeria kills 37 people

Go to video

38 killed in gas blast at Nigeria lead mine

01:18

ISWAP raid kills eight Nigerian soldiers as jihadist attacks intensify in northeast