Zimbabwe

Foreign banks operating in Zimbabwe have submitted credible plans on how they intend to localize their majority shareholding as required by the country’s indigenisation law, the country’s Finance Minister Patrick Chinamasa has said.

According to Xinhua, the announcement by Chinamasa allays fears that the country’s foreign owned banks could have their licenses cancelled by government following an ultimatum issued by the indigenisation minister recently to all foreign owned firms to submit their plans by April 1 or face closure. Some of the banks are subsidiaries of major international financial institutes such as Standard Chartered, Barclays, Old Mutual, South Africa’s Standard Bank and African banking group Ecobank, Xinhua further reports.

The agency adds that under the Indigenization and Economic Empowerment Act that came into force in 2010, all foreign companies operating in Zimbabwe were given a March 1, 2015 deadline to sell at least 51 percent of their holdings to locals but owing to slow compliance, the government extended the deadline to March 31, 2016.

Under the empowerment rules, the foreign-owned banks will have to sell at least 20 percent of shares directly to locals, while empowerment credits, such as funding for agriculture and youth and women programs, make up the balance.

02:25

Zimbabwe’s inventive Valentine’s: Cash bouquets and scrap metal hearts

00:28

South Africa declares national disaster over floods and rains that have killed 30 people

Go to video

Driving instructors teach students how to survive Zimbabwe's deadly roads

11:18

Making Africa’s Creative Sector Bankable {Business Africa}

00:56

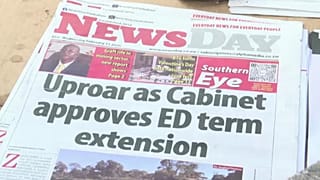

Zimbabwe ZANU-PF moves to extend President’s term

02:23

Zimbabwe girls use ancient Nhanga to combat child marriage